Epf Employer Contribution Rate 2019 20 Pdf

121 e dated the 15th february 2019 as.

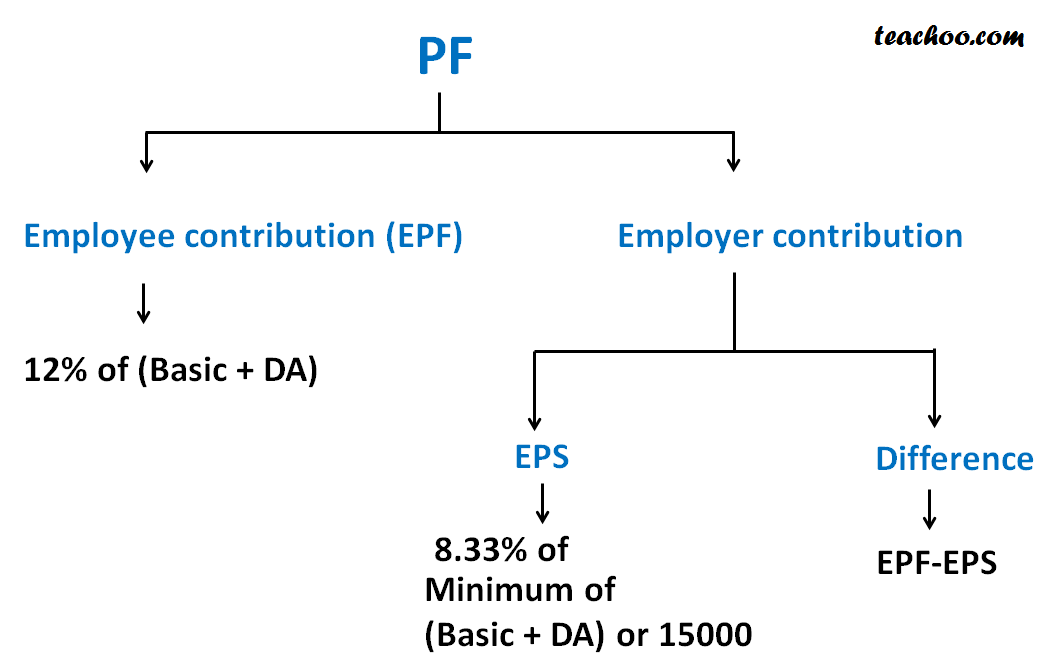

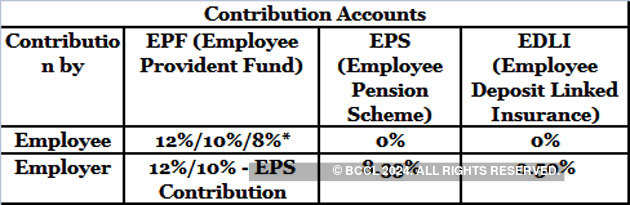

Epf employer contribution rate 2019 20 pdf. For more information check out related articles uan registration uan login pf balance check epf claim status. Employee contribution epf 12 20000 2400 employer contribution eps 8 33 15000 1250 difference 2400 1250 1150 total employer pf 1250 1150 2400 note even if pf is calculated at higher amount for eps we will take 15000 limit only remaining amount wil go to difference. 2 3 67 of employer s share in epf of 20000 inr 734. Under epf the contributions are payable on maximum wage ceiling of rs.

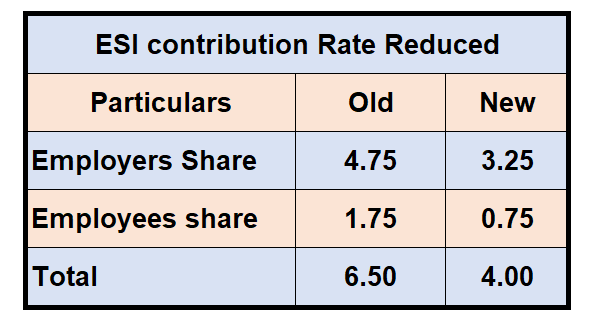

Revised esi contribution rates employer 3 25 employee 0 75. So below is the breakup of epf contribution of a salaried person will look like. A 31011 1 2020 exam 14 dated 20 07 2020 256 5kb 41. Learn more about the responsibilities as an employer paying cpf contributions cpf compliance and enforcement of cpf contributions.

Mole goi notification dt. Employers are required to remit epf contributions based on this schedule. The epf mp act 1952 was enacted by parliament and came into force with effect from 4th march 1952. 1 12 of employees share in epf i e.

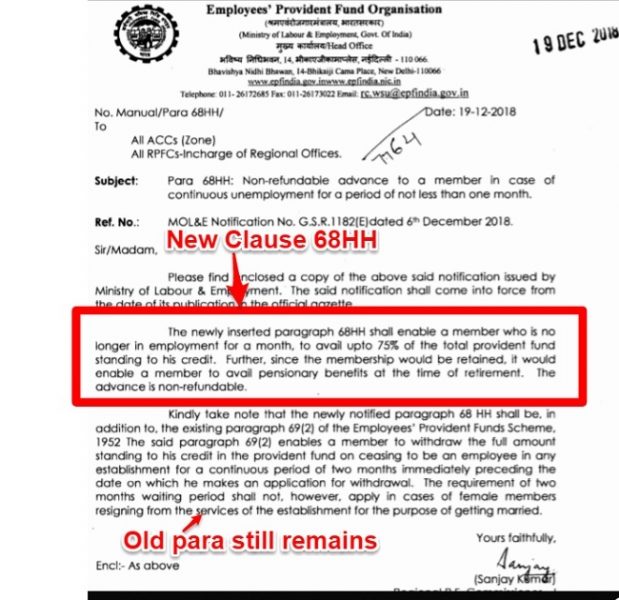

Settlement of death claims on priority basis in events of industrial accidents etc. Monthly contribution rate third schedule the latest contribution rate for employees and employers effective january 2019 salary wage can be referred in thethird schedule epf act 1991 employers are required to remit epf contributions based on this schedule. Visit the cpf website at www cpf gov sg. Let assume the basic salary of a person is inr 20 000.

Notification regarding employees provident fund assistant section officer probationers examination scheme 2020 ho no. The latest contribution rate for employees and employers effective january 2019 salary wage can be referred in the third schedule epf act 1991 click to download. A series of legislative interventions were made in this direction including the employees provident funds miscellaneous provisions act 1952. Now let s have a look at an example of epf contribution.

If the employer pays a higher amount the employer does not have to pay a higher rate as well. If the maximum wage ceiling is rs 15 000 contributions are mandatory. Employees provident fund contribution rate. 15000 the employee can pay at a higher rate and in such case employer is not under any obligation to pay at such higher rate.

12 of 20000 inr 2 400. Contribution for epf.