Gst Tax Code Malaysia

Tax code description gst 03 os txm 0 this refers to out of scope supplies made outside malaysia which will be taxable if made in malaysia.

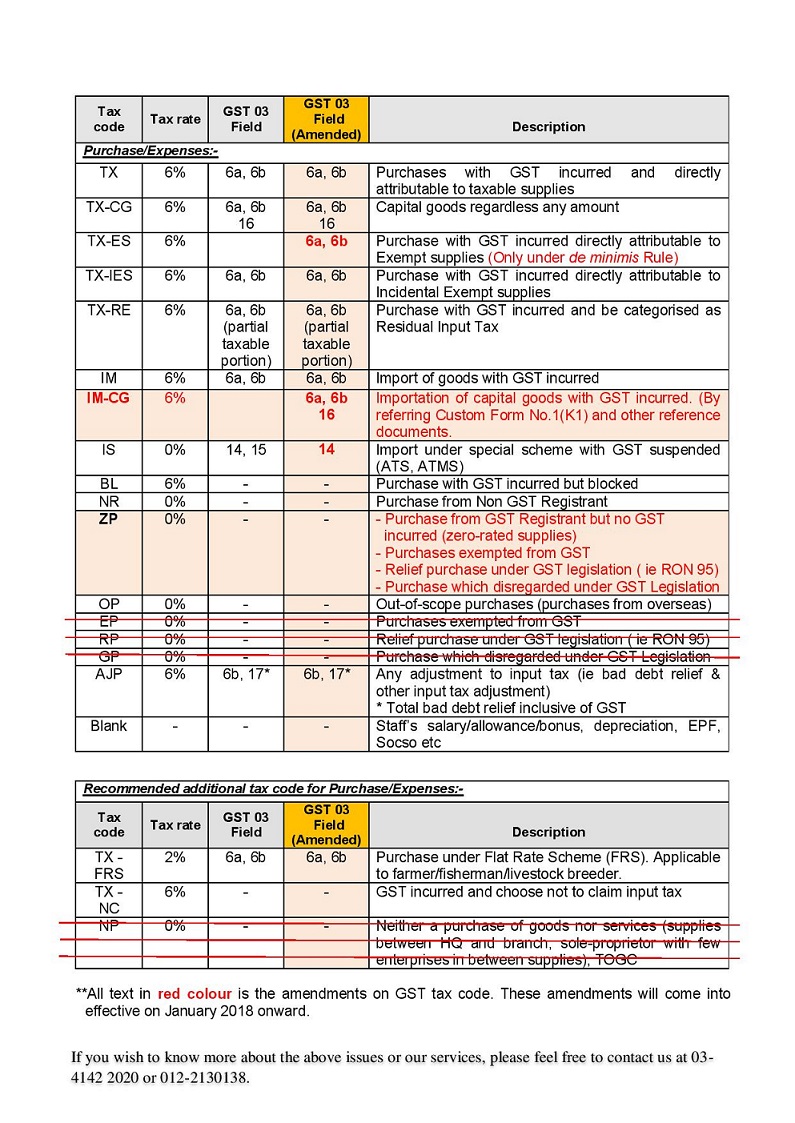

Gst tax code malaysia. Many domestically consumed items such as fresh foods water and electricity are zero rated while some supplies such as education and health services are. The gst tax codes for purchase are as the following. Example for this tax code are purchase of ron95 petrol diesel and other relief supply that been given relief from gst as prescribed under gst relief order 2014. Examples of zero rated supply as prescribed based on tariff code in gst zero rated supply order 2014.

The out of scope supply must comply with malaysia gst legislations to fulfil this tax code conditions. Gst tax codes for purchases. Jabatan kasta m diraja malaysia appendix 2 guide to enhance your accounting software to be gst compliant draft as at 13 march 2014 tx. Customers who are using versions of abss myob that are four versions back will no longer be able to access support from abss.

Payment code is referring to the type of tax that categorized by inland revenue board irb or lembaga hasil dalam negeri lhdn malaysia. Gst code rate description. Gst on purchases directly attributable to taxable supplies. Apa apa permohonan rayuan cbp.

The existing standard rate for gst effective from 1 april 2015 is 6. From 1 january 2019 abss will discontinue technical support for older versions of abss myob products. While making tax payment through various tax payment options taxpayers have to specify a few information such as name of taxpayer employer income tax number employer number identity number and payment code. Purchase transactions which disregarded from charging and payment of gst under gst legislations.

The goods and services tax is an abolished value added tax in malaysia. Gst tax codes in malaysia are defined as recommended code listings in order to allow proper classification of different purchase and supply transactions and these codes are based on common scenarios that are commonly encountered by gst registered companies in malaysia. Recommended tax codes for goods services tax. A gst registered supplier must charge and account gst at 6 for all sales of goods and services made in malaysia unless the supply qualifies for zero rating exemption or falls outside the scope of the proposed gst model.

This os txm is applicable for calculating the input tax recoverable ratio irr. Berikutan pemansuhan akta cukai barang dan perkhidmatan 2014 akta 762 yang berkuat kuasa pada 1 september 2018 semua urusan permohonan rayuan cukai barang dan perkhidmatan cbp telah dipindahkan di bawah bidang kuasa tribunal rayuan kastam kementerian kewangan malaysia. Tx 6 is a gst. Gst tax codes for malaysia.

Refers to all goods imported into malaysia which are subject to gst that is directly attributable to the making of taxable supplies.