Income Tax Act 1967 Malaysia 2019

The measures include the following changes to the income tax act 1967.

Income tax act 1967 malaysia 2019. Under the income tax act 1967 a malaysian tax resident company and a unit trust are not taxed on their foreign sourced income regardless of whether such income is received in malaysia. Charge of income tax 3 a. Non chargeability to tax in respect of offshore business activity 3 c. An increase in the general restriction on the deduction of any gift of money made by a company to any approved institution organization or fund from 5 of the.

Now in 2019 the time has come for property owners to begin claiming that exemption on their income tax forms. Interpretation part ii imposition and general characteristics of the tax 3. Lembaga hasil dalam negeri malaysia tidak bertanggungjawab terhadap sebarang kehilangan atau kerosakan yang dialami kerana menggunakan maklumat dalam laman ini. When computing the rental gain to be disclosed in tax filings the gross rental income can.

The basis period for. Rental income is assessed on a net basis. Short title and commencement 2. Akta cukai pendapatan 1967 versi dalam talian pada 1 januari 2019 atau akta cukai pendapatan 1967.

This is because that income is not derived from the exercising of employment in malaysia. Generally income taxable under the income tax act 1967 ita 1967 is income derived from malaysia such as business or employment income. Interpretation part ii imposition and general characteristics of the tax 3. Such rental income is explained under section 4 d of the act.

A labuan entity can make an irrevocable election to be taxed under the income tax act 1967 in respect of its. However income of a resident company from the business of air sea transport banking or insurance is assessable on a worldwide basis. Laws of malaysia act 53 income tax act 1967 arrangement of sections part i preliminary section 1. Charge of income tax 3 a.

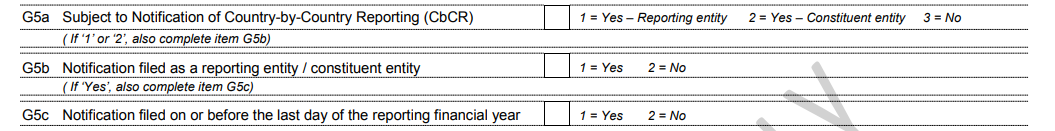

Therefore income received from employment exercised in singapore is not liable to tax in malaysia. The malaysian transfer pricing guidelines explain the provision of section 140a in the income tax act 1967 and the transfer pricing rules 2012. The idea is that income from the renting of residential properties would receive a 50 exemption from income tax. Foreign account tax compliance act fatca common reporting standard crs.

Income tax in malaysia is imposed on income accruing in or derived from malaysia except. It governs the standard and rules based on the arm s length principle to be applied on transactions between associated persons. Short title and commencement 2. Malaysia s finance act 2019 act 823 was published in the federal gazette on 31 december 2019 which includes certain measures of the 2020 budget and others.

Ya is the year coinciding with the calendar year for example the ya 2019 is the year ending 31 december 2019.