Income Tax Act 1967 Malaysia Schedule 3

In ongoing efforts to encourage malaysian businesses to venture overseas and thereafter repatriate their profits to malaysia the government has since 1995 introduced various legislations for tax.

Income tax act 1967 malaysia schedule 3. Non chargeability to tax in respect of offshore business activity 3 c. Income tax deduction for promotion of malaysia international islamic financial centre rules 2009 income tax deduction for expenditure on issuance of islamic securities rules. The income tax act 1967 malay. Akta cukai pendapatan 1967 is a malaysian laws which enacted for the imposition of income tax.

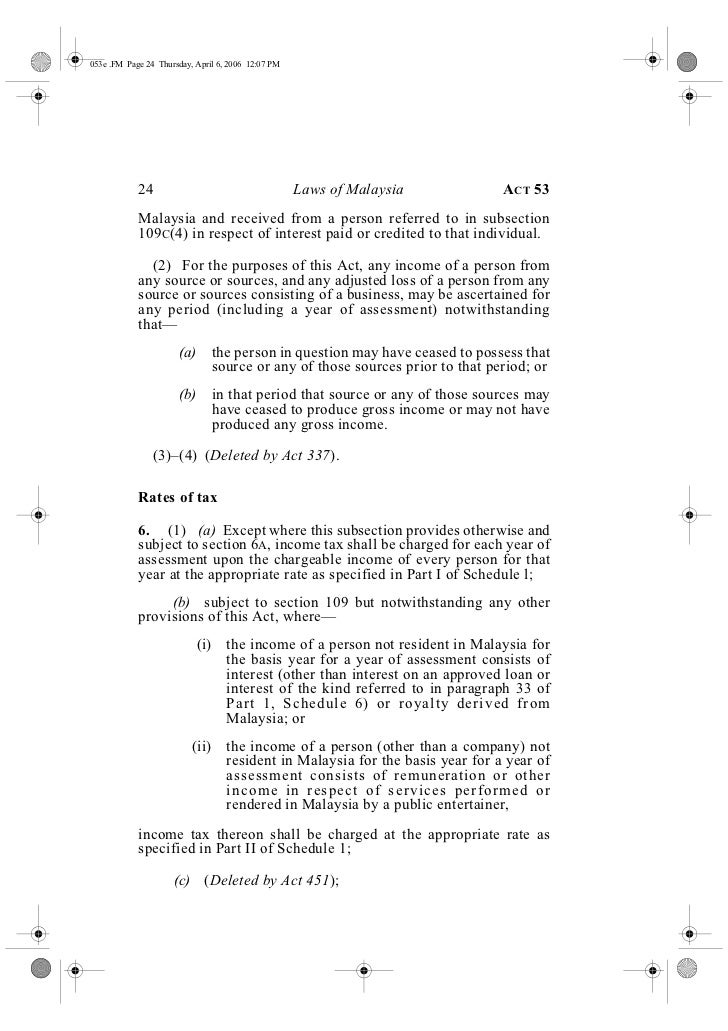

Income tax act 1967 orders subsidiary legislation orders income tax exemption no 24 order 1993 income of an approved research institute or approved research company income tax exemption no 25 order 1993 income of a new technology based firm income tax exemption no 25 order 1995 income of a non resident from shipping pools. Under section 3 of the income tax act 1967 it provides that only income that is accruing in or derived from malaysia and income remitted to malaysia from outside malaysia is subject to tax. The income tax act 1967 in its current form 1 january 2006 consists of 10 parts containing 156 sections and 9 schedules including 77 amendments. Tax exemption of statutory income for 10 years under section 127 of the income tax act 1967 act 53 dividends paid from the exempt income will be exempted from tax in the hands of its shareholders ii an approved ipc rdc status company will enjoy the following benefits.

Foreign account tax compliance act fatca common reporting standard crs country by country. 2020 07 02 16 57 43 ibu pejabat lembaga hasil dalam negeri malaysia menara hasil persiaran rimba permai cyber 8 63000. Any person is exempt from tax by or under this act. Translation from the original bahasa malaysia text public ruling no.

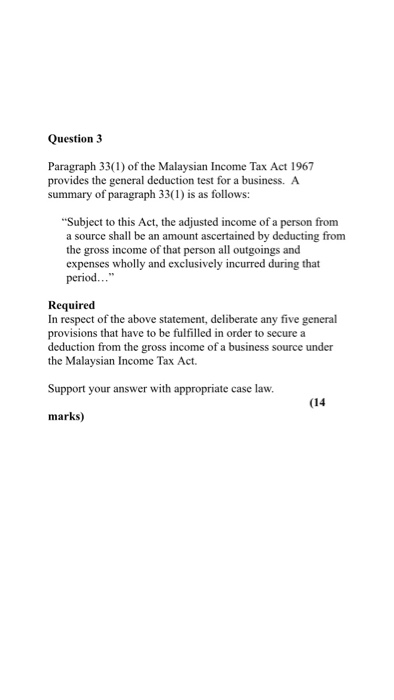

Schedule 3 paragraph 2c inserted by act 476 of 1992 s18 b. Charge of income tax 3 a. 3 laws of malaysia act 53 income tax act 1967 arrangement of sections part i preliminary section 1. However schedule 3 of the income tax act 1967 has laid down several allowable deductions in the form of.

Or any income of any person is exempt from tax by or. Plant was so brought into use in malaysia. Short title and commencement 2. Akta cukai pendapatan 1967 versi dalam talian pada 1 januari 2019 salinan di lawati.

Interpretation part ii imposition and general characteristics of the tax 3. Akta cukai pendapatan 1967 akta 53 pindaan sehingga akta 761 tahun 2014. 2 2001 computation of initial annual allowances in respect of plant machinery 1 0 tax law this ruling applies in respect of the computation of annual allowances for plant and machinery under paragraph 15 schedule 3 income tax act 1967 and the income tax.

.jpg)

.jpg)