Income Tax Rate Malaysia 2018

Jadual average lending rate bank negara malaysia seksyen 140b sekatan ke atas kebolehpotongan faedah seksyen 140c akta cukai pendapatan 1967 edisi bahasa inggeris sahaja study group on asian tax administration and research sgatar.

Income tax rate malaysia 2018. As the clock ticks for personal income tax deadline in malaysia 2018 like gainfully employed malaysians you may have started visiting the lhdn malaysia website to do your e filing as both a proactive and precautionary measure. Resident individuals chargeable income rm ya 2018 2019 tax rm on excess 5 000 0 1 20 000 150 3 35 000 600 8 50 000 1 800 14 70 000 4 600 21 100 000 10 900 24 250 000 46 900 24 5. This guide is for assessment year 2017 please visit our updated income tax guide for assessment year 2019. What is income tax.

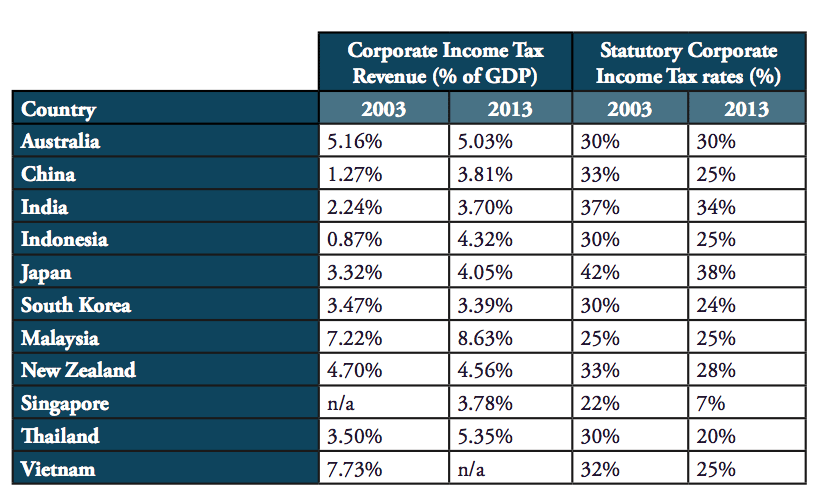

Non resident individuals pay tax at a flat rate of 30 with. Malaysia adopts a territorial system of income taxation a company whether resident or not is assessable on income accrued in or derived from malaysia. 6 2 taxable income and rates 6 3 inheritance and gift tax 6 4 net wealth tax. With effect from ya 2020 a non resident individual is taxed at a flat rate of 30 on total taxable income.

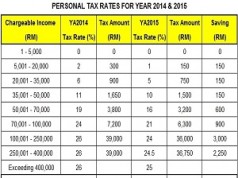

Understanding tax rates and chargeable income. Income tax is a type of tax that governments impose on individuals and companies on all income. On the first 5 000 next. Green technology educational services.

On the first 5 000. Inland revenue board of malaysia shall not be liable for any loss or damage caused by the usage of any. Malaysia taxation and investment 2018 updated april 2018. Calculations rm rate tax rm 0 5 000.

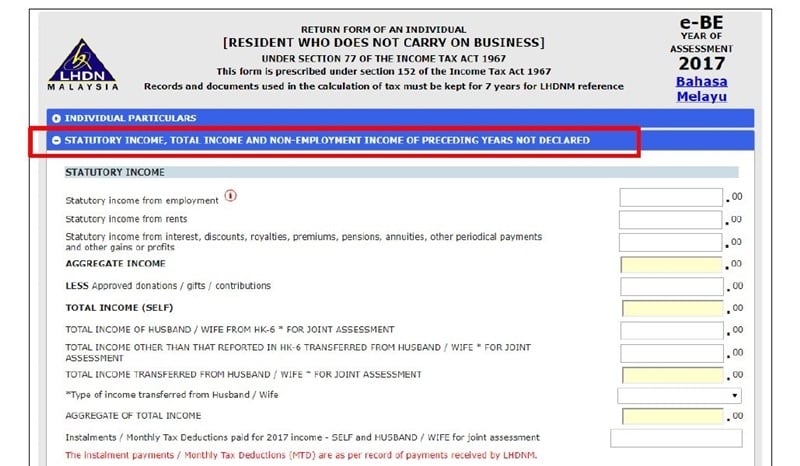

Useful reference information for malaysia s income tax 2018 filing deadline for year of assessment 2017 for be is apr 30 2018 manual form and may 15 2018 e filing. Calculations rm rate tax rm 0 5 000. The standard corporate tax rate of 24 for a period of five years with a possible extension for another five years. 2018 2019 malaysian tax booklet 22 rates of tax 1.

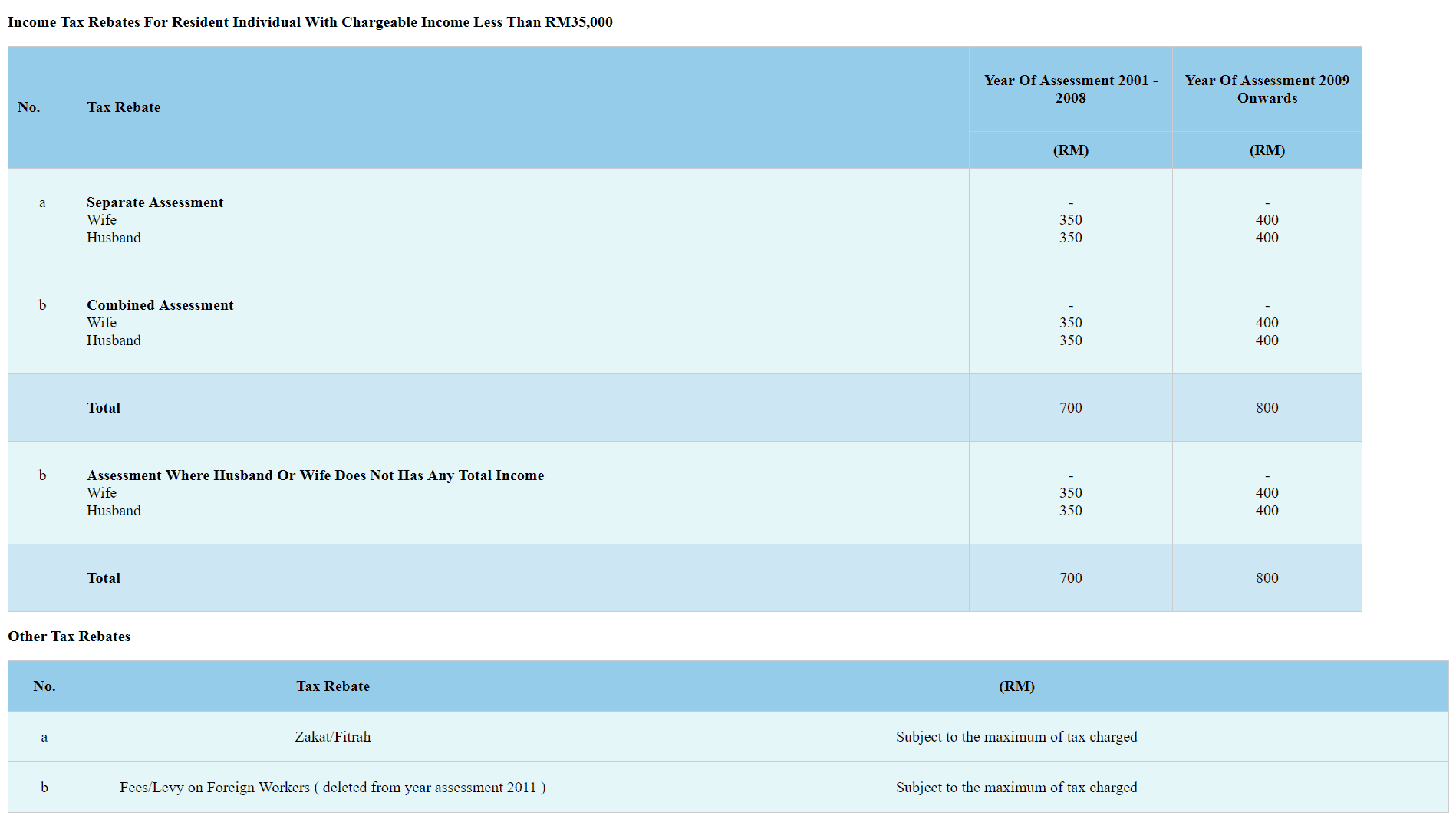

This page is also available in. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a maximum of 30 on chargeable income exceeding rm2 000 000 with effect from ya 2020. Malaysia personal income tax rate. A qualified knowledge worker in a specified area currently only iskandar malaysia is taxed at the concessionary rate of 15 on chargeable income from employment with a designated company engaged in a qualified activity e g.

You don t have to pay taxes in malaysia if you have been employed in the country for less than 60 days or for income that is earned from outside malaysia.