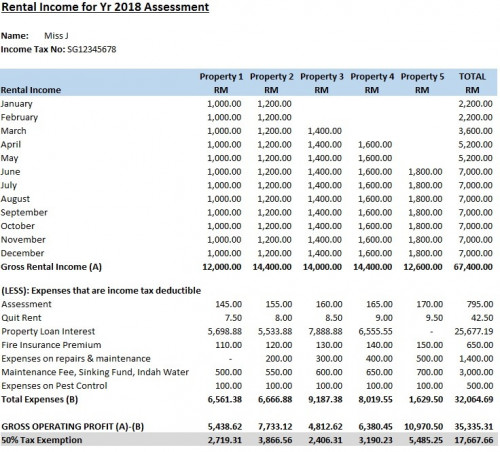

Section 4d Rental Income Tax Computation

Income tax service fees.

Section 4d rental income tax computation. Your property is still subject to property tax which can be calculated by multiplying the annual value av of the property to the applicable property tax rate. The tax treatment of rental properties became a bit more challenging with passage of the 2017 tax cuts and jobs act tax reform. Tax planning on rental income from letting of real property. To support efforts to comply with statutory and regulatory requirements and to provide tax certainty on the deductibility of such expenses a specific deduction under section 14x of the income tax act was introduced with effect from ya 2014.

Rent received from a residential as well as commercial property like shop malls godowns etc. As the properties are located in malaysia the rental income from the letting of properties is regarded as malaysian derived income. Therefore you are required to declare the rental income to irb by completing and submitting the relevant tax return form. From the computation below rental income with trading loss can be set off against net rental income and enjoy a lower tax payable.

Rental income from any buildings or lands appurtenant thereto owned by you shall be chargeable to tax under the head house property. However commuted value of pension is specifically exempted under section 10 10a of the income tax act and the amount of exemption depends on the fact whether or not you have received gratuity at. The area in question is the new section 199a deduction. Income received from the letting of the real property is charged to tax as rental income under paragraph 4 d of the ita.

Rental income is subject to income tax. S 4 d rental income letting of real property as a non business source under paragraph 4 d. The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property. In malaysia income derived from letting of real properties is taxable under paragraph 4 a business income or 4 d rental income of the income tax act 1967.

If you are among the more than 20 million taxpayers who report rental income on your tax return having a clear strategy for figuring out your tax liability is a must before you begin 2019 tax preparation. Such rental income is explained under section 4 d of the act. Taxable rental income. Generally malaysian derived income is subject to malaysian income tax.

Rental income is assessed on a net basis. Azrie owns 2 units of apartment and lets out those units to 2 tenants.