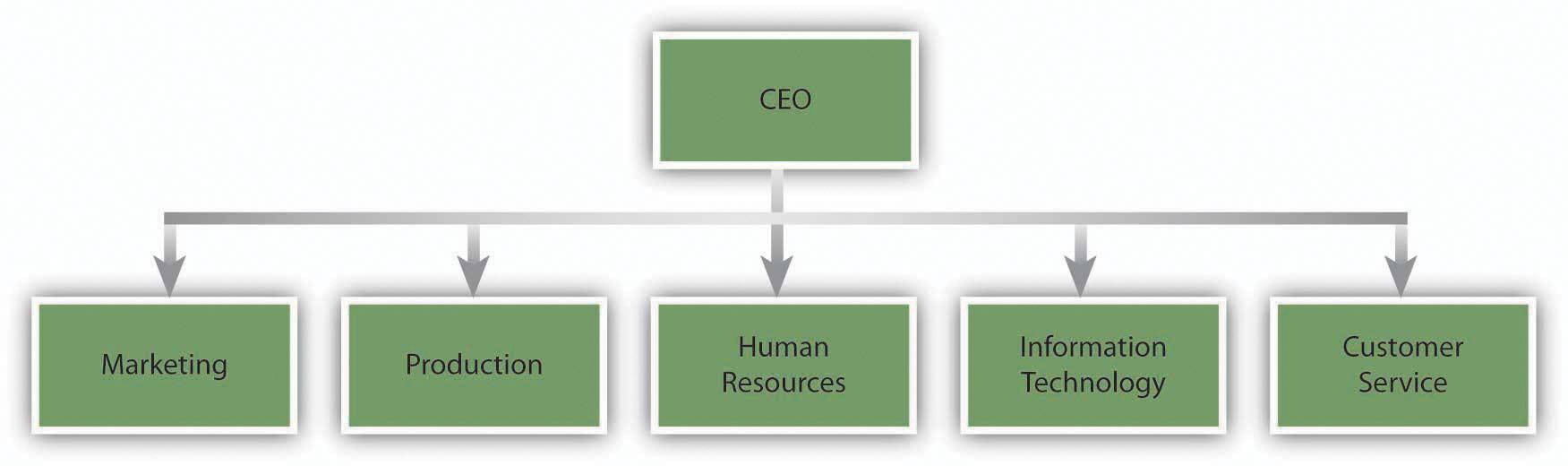

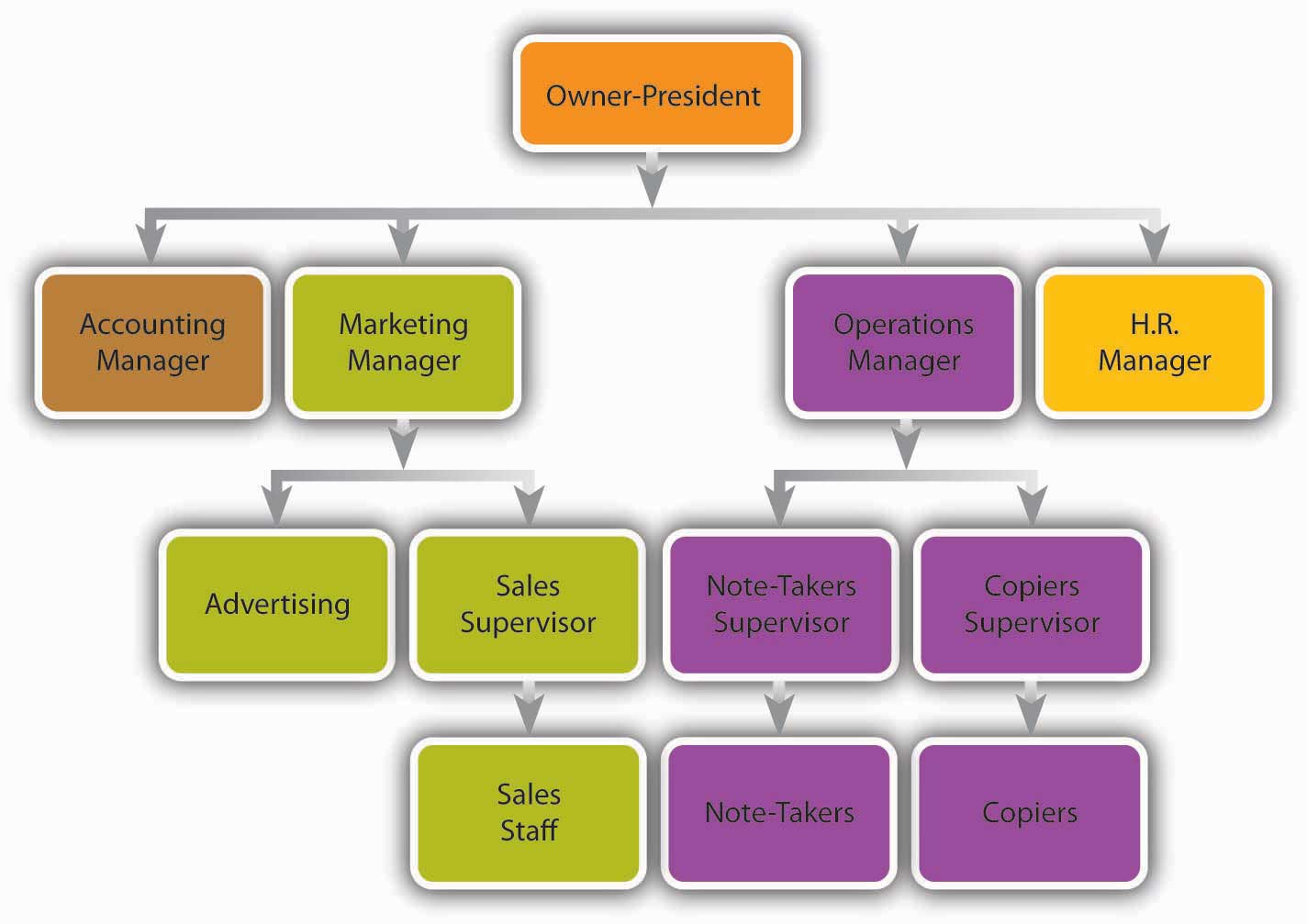

Single Proprietorship Sole Proprietorship Organizational Chart

Essentially you the owner are the business.

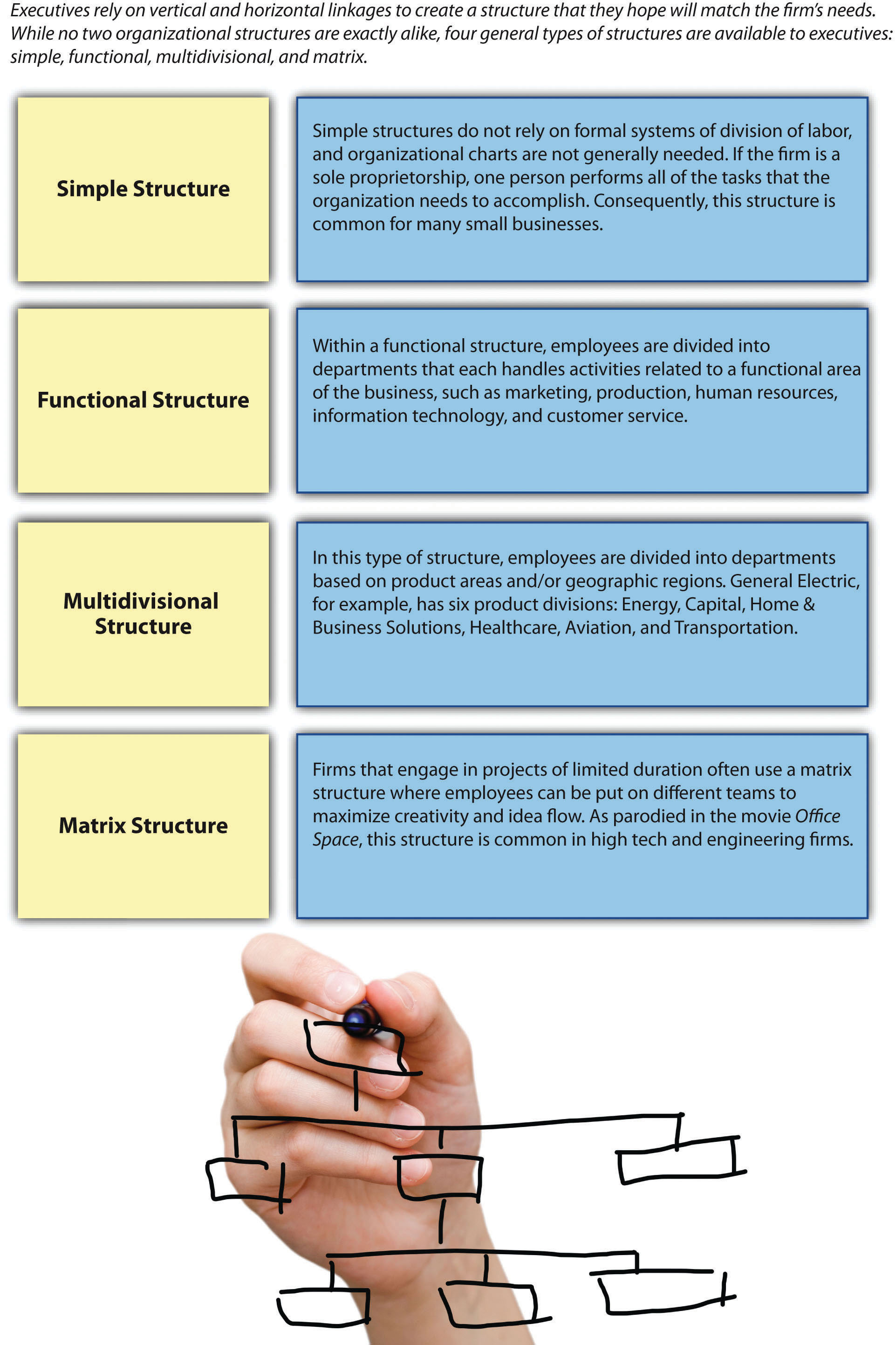

Single proprietorship sole proprietorship organizational chart. Business earnings are taxed as personal earnings. A sole proprietorship is the simplest business setup. A sole proprietor is a business of one without a corporation or limited liability status. The sole proprietorship is the most common form of business organization.

This form of business has several advantages. In fact it has no formal requirements other than any local business registrations. The business owner is personally liable for all debts and contracts. A sole proprietor can authorize employees to make certain types of decisions typically those with limited scope such as making inventory purchases.

More formal structures include. It is are owned and operated by a single individual who has the final say about strategic financial and marketing matters. Organizational form sole proprietorship. The individual represents the company legally and fully.

Even if a sole proprietor hires employees a sole proprietorship is in effect a benevolent dictatorship. The organizational structure for a sole proprietorship is used for a single owner operator who is legally and financially responsible for every aspect of the business. A sole proprietorship business is a kind of business or form of business enterprise owned financed and managed by one person with the primary aim of making a profit. A sole proprietorship has a simple organizational structure.

Organization form refers to the type of business structure you choose when setting up your company. It is one of the common forms of business organizations and the oldest. The profits of the business are considered as personal income and therefore are taxed at your personal rate. You own and operate the business and have sole responsibility and control.

/dotdash_Final_Sole_Proprietorship_May_2020-01-72456bd5ac0d4c868d8f55a2718dbdd2.jpg)