Statutory Income From Employment Malaysia

Subject to any other applicable statutory requirements eg.

Statutory income from employment malaysia. The 5 types of monetary benefits are. Form m employment income form m business income form p. What is malaysian employment law. Civil servants and workers in local authorities and statutory bodies.

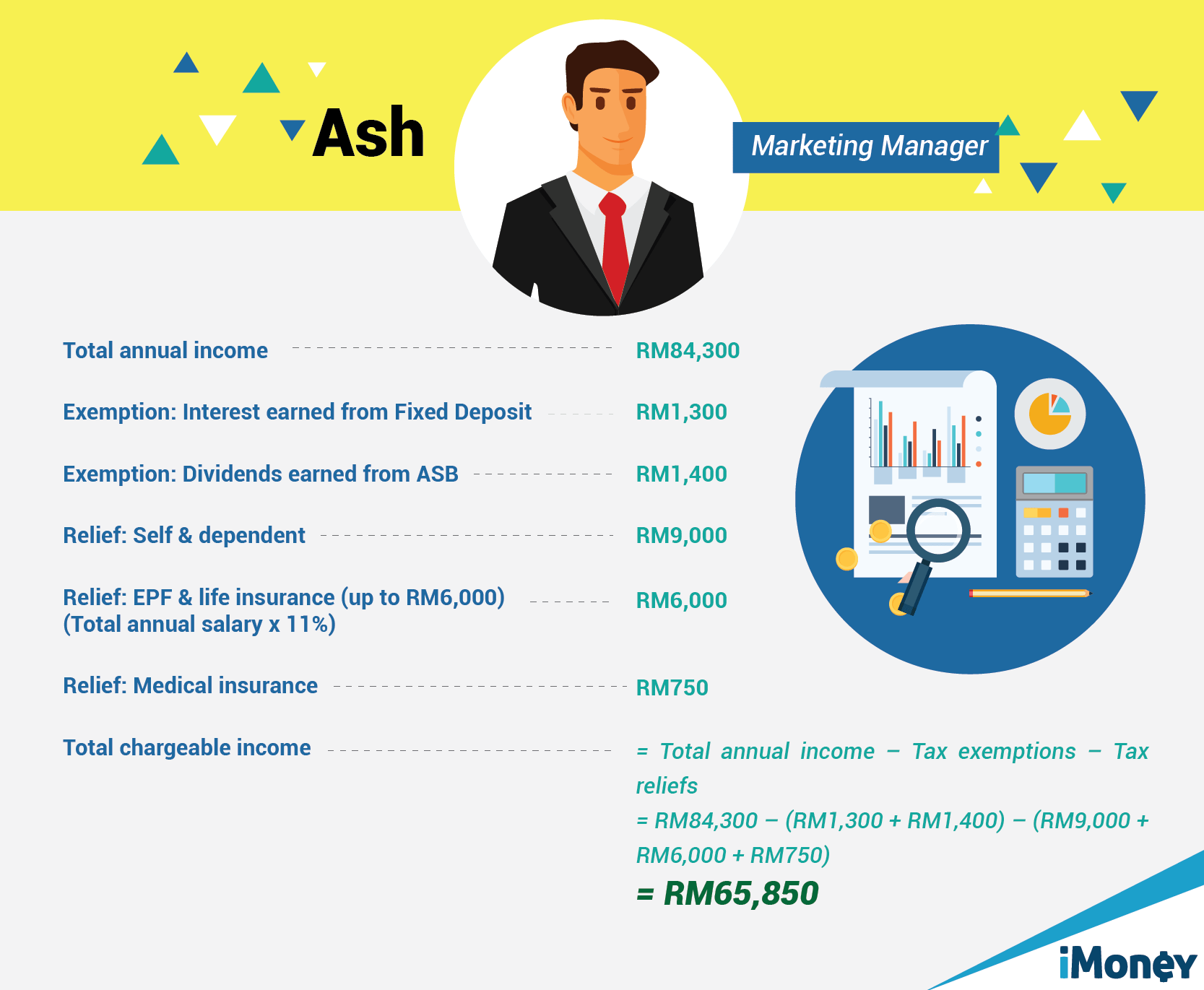

Income tax in malaysia for employment income a monthly tax deduction mtd system is in operation whereby employers deduct monthly tax payments from the employment income of their employees. Statutory payroll contributions in malaysia on. Employers who do not use computerised payroll software can calculate the mtd using the schedule of monthly tax deductions issued by inland revenue board of malaysia irbm. Minimum retirement age socso and epf etc.

Subject to any other applicable statutory requirements eg. Minimum retirement age socso and epf etc. Types of income under section 13 1 of the act states that the gross income of an employee concerning gains or profit from an employment includes. Monthly income tax deduction.

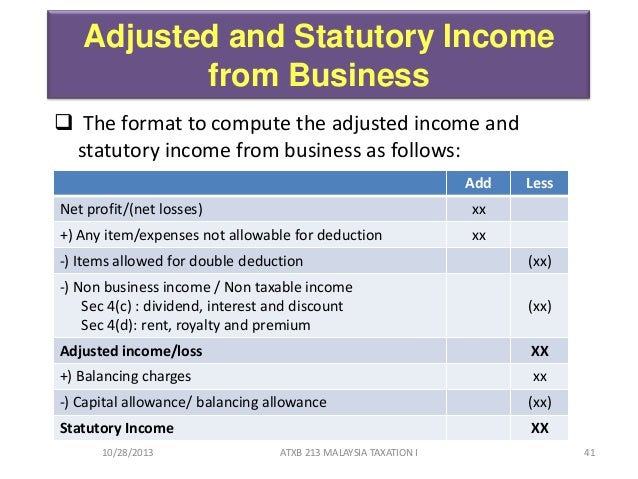

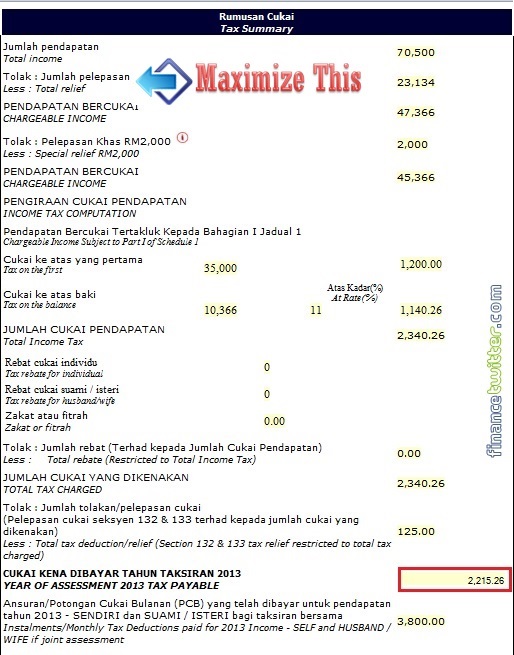

Hk 2 computation of statutory income from employment hk 2 1 receipts under paragraph 13 1 a hk 2 2 computation of taxable gratuity hk 2 3 computation of tax allowance. 30 jun 2020. Computation of aggregate income 14 9. Lembaga hasil dalam negeri inland revenue board of malaysia form b.

Value of living accommodation in malaysia provided for the employee by or on behalf of the employer rent free or otherwise. In the statutory income total income and non employment income of preceding years not declared section key in your income details in the relevant categories. Job search allowance se reduced income allowance ria. Agreement with malaysia and claim for section 132 tax relief hk 9.

Gross employment income what are the types of income which are taxable and subject to monthly tax deduction mtd or in bahasa malaysia potongan cukai berjadual pcb. Computation of statutory income 8 8. 7 3 in respect of employment income the components of gross income are as follows. The employment insurance system office offers two kinds of benefits namely monetary benefits and job search assistance.

For computing the statutory income from employment. Fill in the approved donation and gifts amount. Employment law in malaysia is generally governed by the employment act 1955. Monthly income tax deduction.