Tax Table 2017 Malaysia

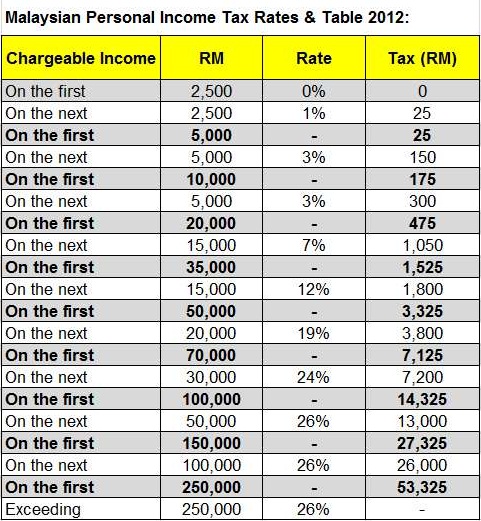

Some items in bold for the above table deserve special mention.

Tax table 2017 malaysia. In malaysia for at least 182 days in a calendar year. Headquarters of inland revenue board of malaysia menara hasil persiaran rimba permai cyber 8 63000 cyberjaya selangor. Pwc 2016 2017 malaysian tax booklet personal income tax tax residence status of individuals an individual is regarded as tax resident if he meets any of the following conditions i e. Technical or management service fees are only liable to tax if the services are rendered in malaysia while the 28 tax rate for non residents is a 3 increase from the previous year s 25.

Information on malaysian income tax rates. Payments made to non residents in respect of the provision of any advice assistance or services performed in malaysia and rental of movable properties are subject to a 10 wht unless exempted under statutory provisions for purpose of granting incentives. Amount rm 1. The main measures regarding corporate taxation which are effective from 1 january 2017 are summarized below.

Reduction in corporate income tax between 1 and 4 based on percentage of chargeable income increased compared with the previous year of assessment ya. Chargeable income calculations rm rate tax rm 0 2500. Such qualifying persons are required to have been carrying on a business for more than two years and earned chargeable. The income tax exemption no.

9 order 2017 p u a 323 was gazetted on 24 october 2017. Melayu malay 简体中文 chinese simplified malaysia personal income tax rate. 150 last update. Year of assessment 2019.

Receiving further education in malaysia in respect of an award of diploma or higher. Tax relief for resident individual. Total deposit in year 2017 minus total withdrawal in year 2017 6 000. On the first 2 500.

2 order 2017 was gazetted to provide a special income tax exemption for companies limited liability partnerships trust bodies executors of estates and receivers under subsection 68 4 of the income tax act 1967 the act. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a maximum of 30 on chargeable income exceeding rm2 000 000 with effect from ya 2020. The budget for 2017 was presented on 21 october 2016. This page is also available in.

This order exempts a person not resident in malaysia from income tax payment in respect of income falling under section 4a i and ii of the ita 1967 where services are rendered and performed outside malaysia.