Employer Epf Contribution Rate In Malaysia

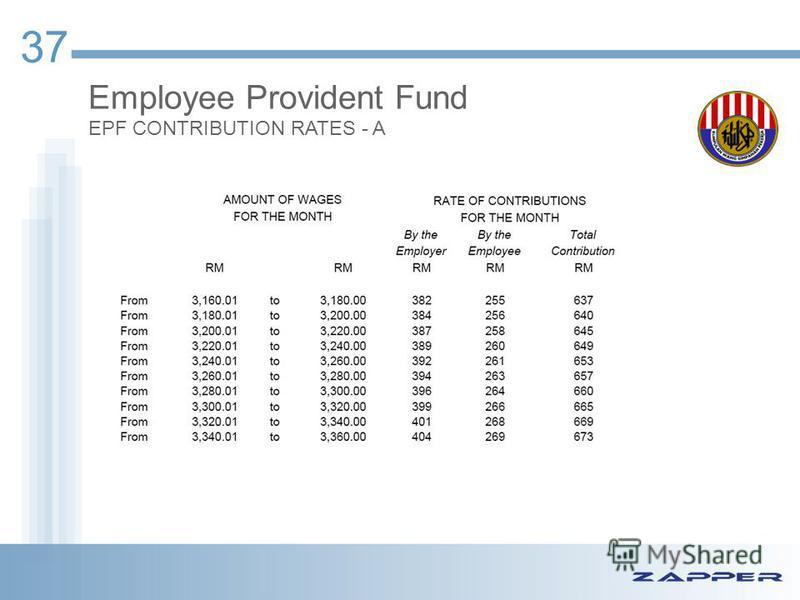

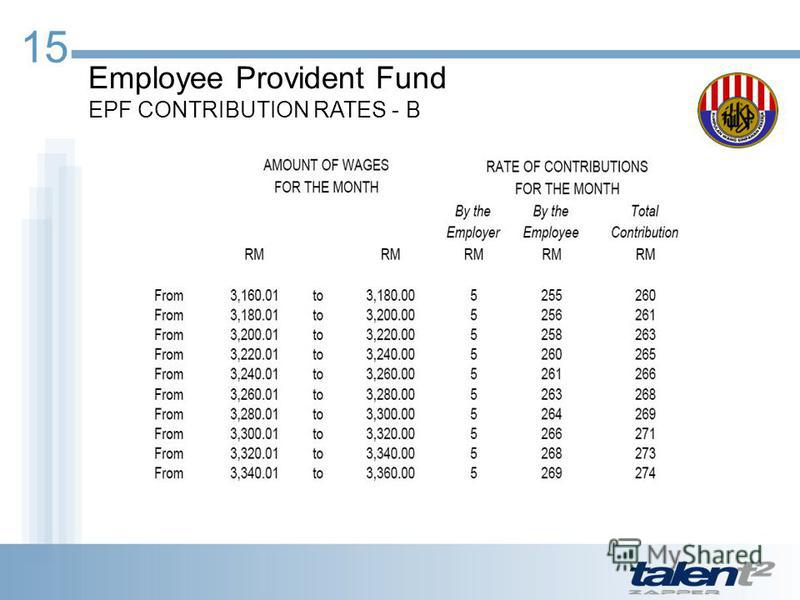

Monthly contribution rate third schedule the latest contribution rate for employees and employers effective january 2019 salary wage can be referred in thethird schedule epf act 1991 employers are required to remit epf contributions based on this schedule.

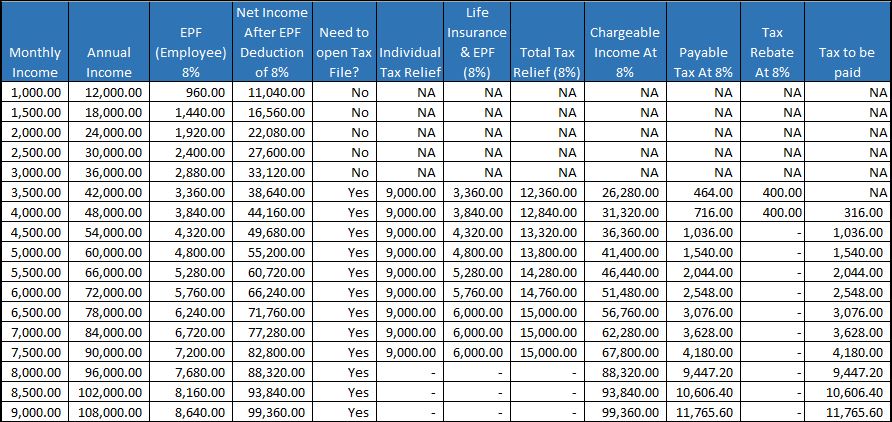

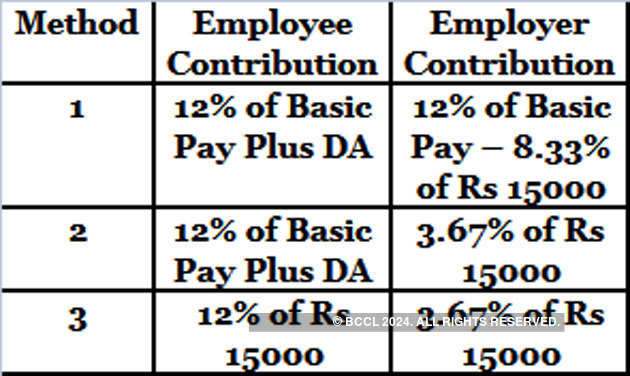

Employer epf contribution rate in malaysia. Employees provident fund malaysia epf is a federal statutory body under the purview of the ministry of finance employees provident fund epf will allow education withdrawals for professional certificate programmes under budget 2020 every company is required to contribute epf calculator for its staff workers and to remit the contribution sum to kwsp before the 15th day of the following. The malaysian government has reduced the minimum employee contribution rate for the employees provident fund epf to 7 starting from april 1 in a bid to cushion the impact of the covid 19. The minimum employee contribution rate for the employees provident fund epf will be set at 9 starting from january 2021 for a period of 12 months. The announcement was made by finance minister tengku zafrul aziz today during the tabling of budget 2021.