Epf Employer Contribution Rate 2020 Malaysia

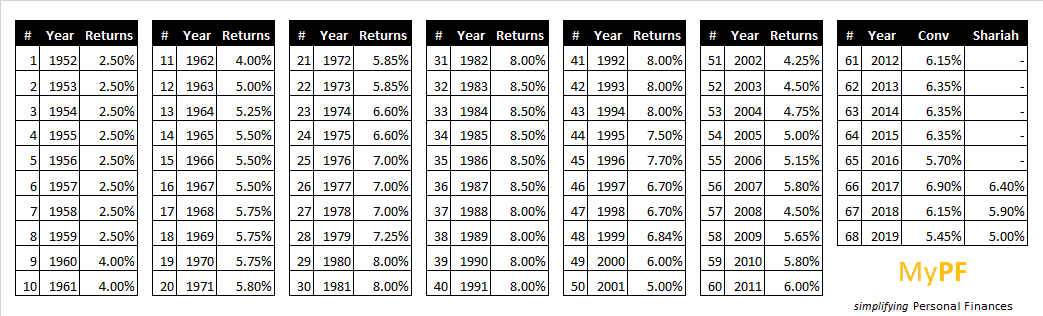

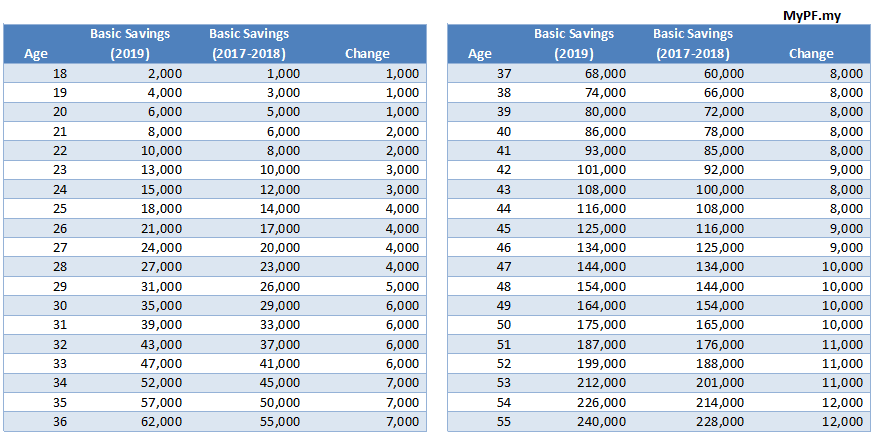

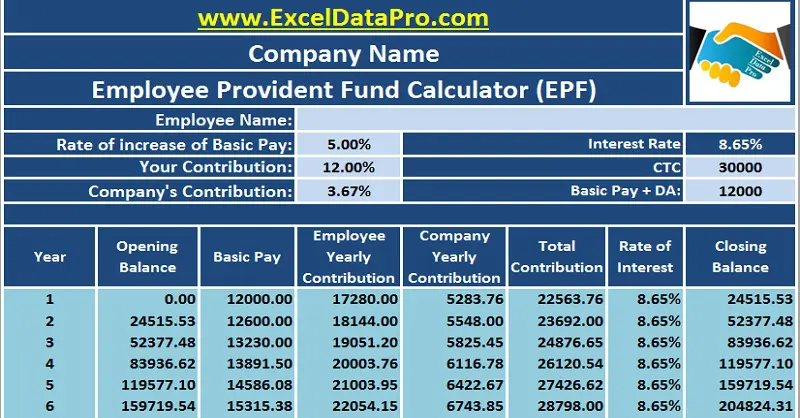

Employees provident fund malaysia epf is a federal statutory body under the purview of the ministry of finance employees provident fund epf will allow education withdrawals for professional certificate programmes under budget 2020 every company is required to contribute epf calculator for its staff workers and to remit the contribution sum to kwsp before the 15th day of the following.

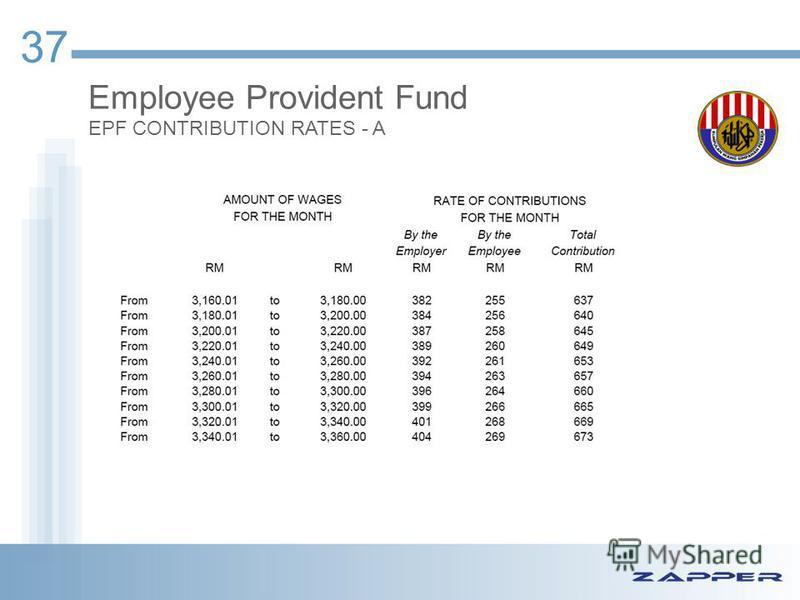

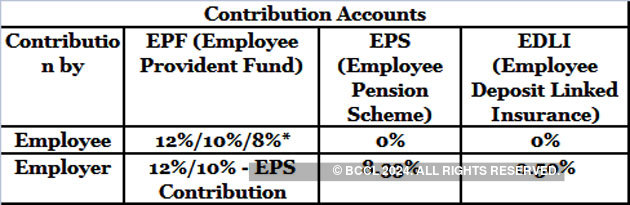

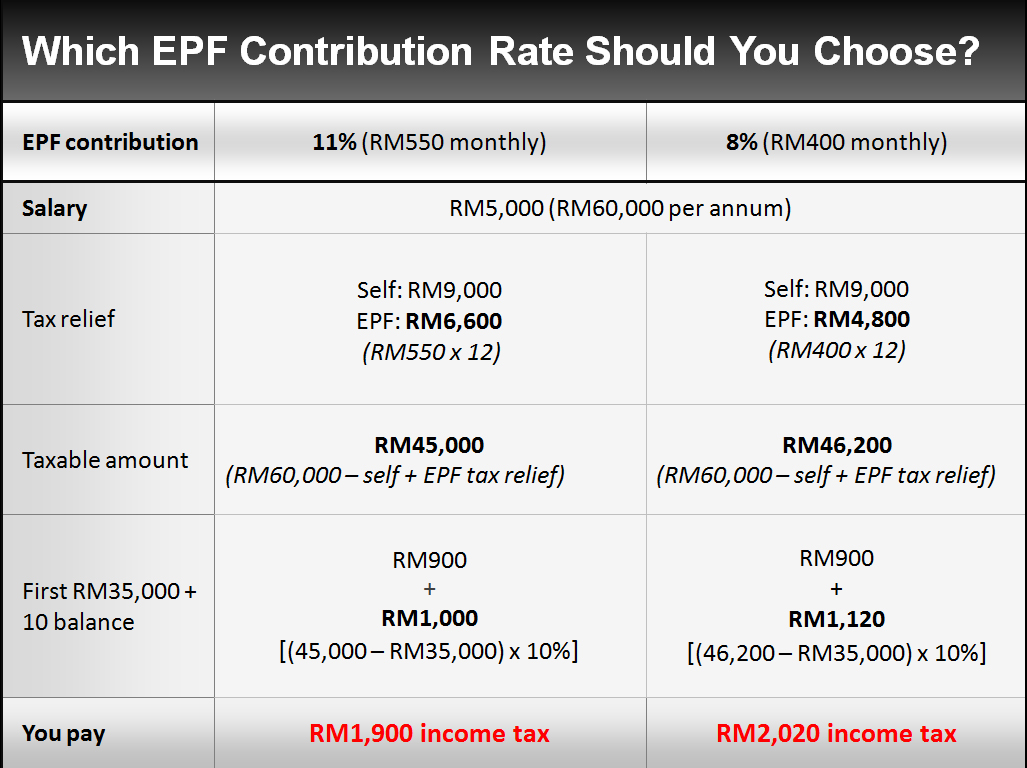

Epf employer contribution rate 2020 malaysia. Epf employee contribution rate has been revised from 11 to 7 from 1 april 2020 until 31 december 2020. The new statutory contribution rate for employees will impact wages paid for april until december 2020 which are reflected in epf contribution submissions from may 2020 till january 2021. The rate of statutory contribution for employees aged 60 years and above remain the same the statement said. Currently employees contribute 11 of their salary to epf while employers must put in a minimum of 12 for salaries more than rm5 000 and 13 for salaries lower than that.

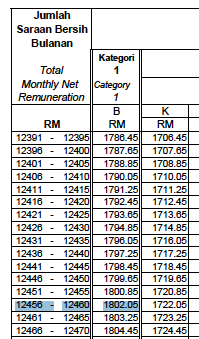

The malaysian government has reduced the minimum employee contribution rate for the employees provident fund epf to 7 starting from april 1 in a bid to cushion the impact of the covid 19. Your mandatory contribution is calculated based on your monthly salary as an employee in accordance with the contribution rate third schedule monthly contributions are made up of the employee s and employer s share which is paid by the employer through various methods available to them. For employees aged 60 years old and below. For the exact contribution amount refer to the contribution schedule jadual or head over to the epf contribution website.

Government employees domestic workers and the self employed are exempt. Employees may choose to maintain the current contribution rate of 11 per cent by completing borang kwsp 17a khas 2020 which must be submitted to epf through their employers and is effective in the following month. Contribution rates are set out in the second schedule and subject to the rules in section 18 of the employment insurance system act 2017 eis table. Kuala lumpur feb 27 the minimum contribution rate under the employees provident fund epf will be cut from 11 per cent to 7 per cent from april 1 until december 31 this year with the aim of potentially unlocking up to rm10 billion worth of spending by malaysians to help drive the economy that has been hit by the global covid 19 virus outbreak.

What are the minimum contribution rates. Employees have the option to opt out from the scheme and maintain the rate at 11 by completing borang kwsp 17a khas 2020. For employees who receive wages salary exceeding rm5 000 the employee s contribution of 11 remains while the employer s contribution is 12.