Epf Employer Contribution Rate 2020 Schedule

Union finance minister nirmala sitharaman on 13 05 2020 announced the statutory provident fund or pf contribution of both employer and employee will be reduced to 10 each from existing 12 each for all establishments covered by epfo for the next three months i e.

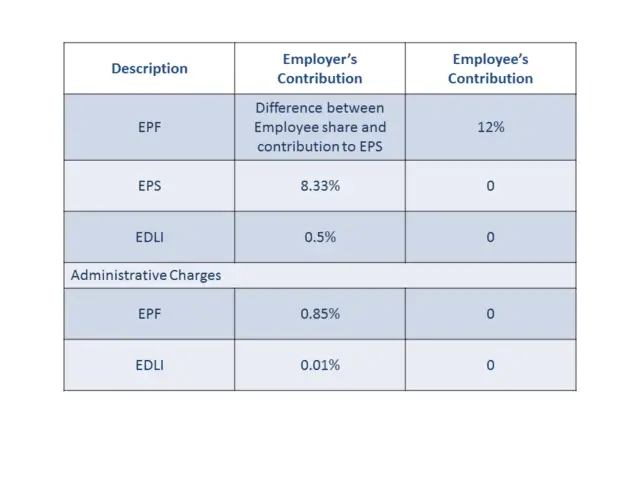

Epf employer contribution rate 2020 schedule. The latest contribution rate for employees and employers effective january 2019 salary wage can be referred in thethird schedule epf act 1991. What are the minimum contribution rates. May 2020 june 2020 july 2020. Under epf the contributions are payable on maximum wage ceiling of rs.

To pay contribution on higher wages a joint request from employee and employer is required para 26 6 of epf scheme. The establishments which were already entitled to reduced rate of contribution 10 through the so 320 e dated 09 04 1997 are not eligible for any further reduction in rate of contribution. Yes the rate of contributions is 10 for the three wage months may 2020 june 2020 and july 2020 irrespective of date of payment. The 7 contribution rate will take effect from 1st april 2020 until the end of 2020 and it will be applicable to all epf members under 60 years of age that are subject to statutory contribution.

15000 the employee can pay at a higher rate and in such case employer is not under any obligation to pay at such higher rate. For late contribution payments employers are required to remit contributions in accordance with the third schedule as. For the exact contribution amount refer to the contribution schedule jadual or head over to the epf contribution website. Epf employee contribution rate has been revised from 11 to 7 from 1 april 2020 until 31 december 2020.