Epf Employer Contribution Rate 2020

15000 the employee can pay at a higher rate and in such case employer is not under any obligation to pay at such higher rate.

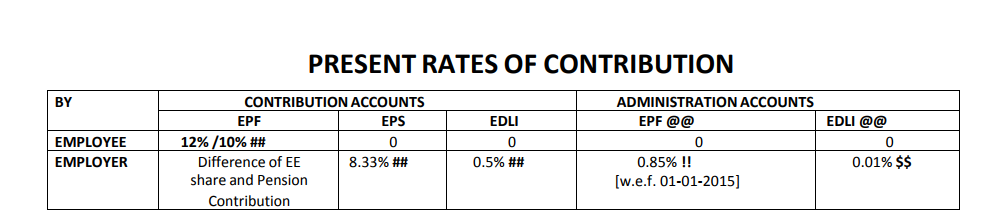

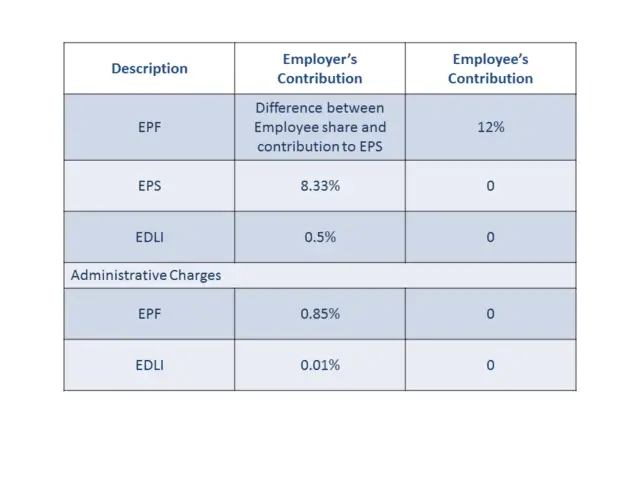

Epf employer contribution rate 2020. Income tax benefits on epf contributions. Since the reduced employees provident fund epf contribution amount was for three months till july from august. To pay contribution on higher wages a joint request from employee and employer is required para 26 6 of epf scheme. Under epf the contributions are payable on maximum wage ceiling of rs.

Employee provident fund epf refers to the scheme which provides monetary benefits to the salaried class people upon retirement it is governed by the employees provident funds and miscellaneous provisions act 1952 epf mp act 1952. Government to pay epf contributions of employees and employers till aug 2020. Kuala lumpur 27 february 2020. Govt notifies cut in epf contribution to 10 for may june july.

The new rate will be effective starting 1 april 2020 until the end of the year and affects members below age 60. The act extends to the whole of india except the state of jammu and kashmir. Union finance minister nirmala sitharaman on 13 05 2020 announced the statutory. Monthly contribution rate third schedule the latest contribution rate for employees and employers effective january 2019 salary wage can be referred in thethird schedule epf act 1991 employers are required to remit epf contributions based on this schedule.

As part of the government s atma nirbhar bharat package in may 2020 finance minister nirmala sitharaman announced that monthly epf contributions of both employers and employees was to be reduced from 24 per cent to 20 per cent for the months of may june and july 2020. The 7 contribution rate will take effect from 1st april 2020 until the end of 2020 and it will be applicable to all epf members under 60 years of age that are subject to statutory contribution. It is applicable to every establishment which employs 20 or more employees and. May 20 june 20 july 20.

Under the self reliant india package announced by the hon ble finance minister fm on 13 may 2020 the rate of employees provident fund epf contribution for both employer and employee will be reduced to 10 from existing 12 the objective of the said amendment is to provide more liquidity in the hands of both employer. An overview of announcement by honorable finance minister nirmala sitharaman on wednesday 13 05 2020 regarding epf contribution by which epf contribution was reduced for employers and employees for 3 months to 10 from 12 for all establishments covered by epfo for next 3 months i e. The employees provident fund epf takes note of the government s decision on the reduced minimum statutory contribution rate for employees from 11 per cent to seven 7 per cent as announced today. New vs existing tax regime.

Cut in employer s epf contribution may mean net loss for the employees.